On August 8, 2023, the Jiangxi government procurement website released the announcement of winning the bid for the surgical robot project of the First People's Hospital of Jiujiang City: the domestic Jingfeng four-arm endoscopic surgical robot MP1000 and TINAVI orthopedic robot jointly won the bid, with a total contract amount of 16.145 million yuan. According to the estimation of the minimum winning bid price of about 7 million yuan for TINAVI orthopedic robots, the winning bid price of Jingfeng MP1000 may be less than 10 million yuan, which may be the first time that a domestic four-arm laparoscopic surgical robot has broken the 10 million yuan mark.

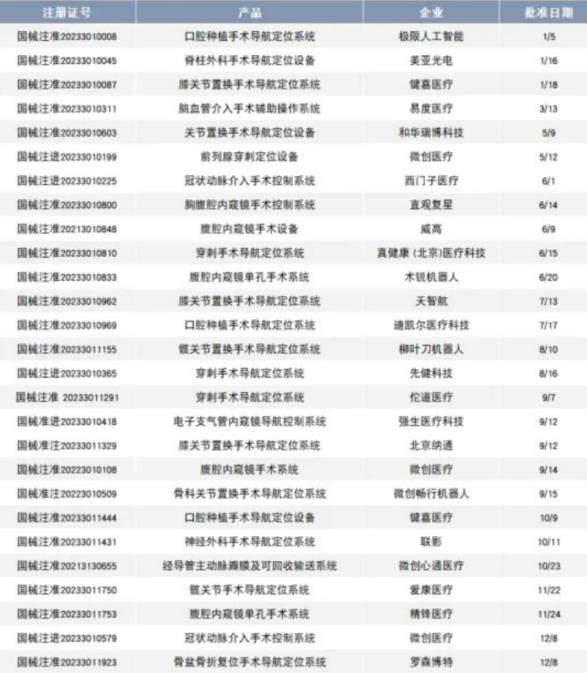

2023 is a booming year for the surgical robotics industry. According to statistics, in 2021, only 6 surgical robots in China were registered by the State Food and Drug Administration, and by 2023, this number has surged to 28, showing the rapid expansion of the market.

Laparoscopic surgical robots have ushered in the peak of approvals in 2023. Kangduo SR1000 (urology), domestic da Vinci surgical robot IS4000CN, Shurui laparoscopic single-port surgical system, Jingfeng laparoscopic endoscopic surgery system (adult urology, gynecology, thoracic surgery, general surgery), Shanghai minimally invasive laparoscopic endoscopic surgery system (adult and pediatric urology, gynecology, thoracic surgery, general surgery) and Jingfeng's gynecological single-port surgical system and other products have been approved. In addition, in April this year, the Condo SR1500 surgical robot (urology) was approved, and in July, the condo four-arm laparoscopic surgical robot (urology) was also successfully approved.

The competition in China's surgical robot market is becoming increasingly fierce. The Administrative Measures for the Allocation and Use of Large-scale Medical Equipment have been implemented since 2005, and in recent years, the government has gradually relaxed control and promoted some equipment to be adjusted from Class A to Class B, or directly removed from the catalog. After the laparoscopic surgical robot was adjusted from Class A to Class B equipment in 2018, the number of configuration certificates has been increasing, especially in the "14th Five-Year Plan", with 559 new units. This policy change has accelerated the rapid growth of the laparoscopic surgical robot market. According to Frost & Sullivan, between 2017 and 2021, the market size of China's laparoscopic surgical robots increased from 700 million yuan to 3.24 billion yuan, with a compound annual growth rate of 46.7%.

In the Chinese market, the da Vinci surgical robot has served more than 540,000 patients, covering more than 300 hospitals across the country, with a cumulative installed capacity of more than 380 units, occupying a dominant position in the market. ACCORDING TO DATA FROM MDCLOUD (MEDICAL DEVICE DATA CLOUD), IN 2023, INTUITIVE MEDICAL WILL OCCUPY 72.7% OF THE MARKET SHARE OF CHINA'S SURGICAL ROBOTS, RANKING FIRST; Medtronic ranked second with a 4.3% market share; TINAVI ranked third with a market share of 3.4%.

2023 Annual Surgical Robot Brand Ranking (Top10)

|

Rank |

Brand |

Percentage of the total |

Percentage of volume |

|

1 |

直观医疗 INTUITIVE |

72.70% |

36.00% |

|

2 |

美敦力 MEDTRONIC |

4.30% |

12.50% |

|

3 |

天智航 TINAVI |

3.40% |

2.90% |

|

4 |

华科精准 SINOVATION |

2.40% |

6.10% |

|

5 |

博医来 BRAINLAB |

2.10% |

5.60% |

|

6 |

美骨 MAKO |

1.70% |

0.80% |

|

7 |

精锋医疗 |

1.70% |

1.10% |

|

8 |

迈梭 MAZOR |

1.50% |

0.80% |

|

9 |

史赛克 STRYKER |

1.00% |

0.80% |

|

10 |

柏惠维康 REMEBOT |

1.00% |

2.90% |

The 2023 surgical robot brand ranking shows that Intuitive Medical has a clear advantage in terms of the amount and number of winning bids. TINAVI and Jingfeng Medical followed closely behind, with TINAVI's TiRobot ForcePro Superior and Jingfeng MP1000 accounting for 3.3% and 1.9% of the total bids, respectively.

2023 Annual Surgical Robot Brand Model Ranking (Top10)

|

Rank |

Brand |

Specifications and models |

Percentage of the total |

Percentage of volume |

|

1 |

直观医疗 INTUITIVE |

IS4000 |

18.30% |

7.10% |

|

2 |

天智航 TINAVI |

TIROBOT FORCEPRO SUPERIOR |

3.30% |

2.40% |

|

3 |

精锋医疗 |

MP1000 |

1.90% |

1.20% |

|

4 |

直观医疗 INTUITIVE |

DA VINCI IS4000 |

1.80% |

0.60% |

|

5 |

迈梭 MAZOR |

MAZOR X STEALTH EDITION |

1.70% |

0.90% |

|

6 |

美敦力 MEDTRONIC |

S8 SPINE |

1.70% |

4.20% |

|

7 |

博医来 BRAINLAB |

CURVE NAVIGATION 17700 |

1.40% |

3.30% |

|

8 |

直观医疗 INTUITIVE |

470375 |

1.20% |

0.60% |

|

9 |

直观医疗 INTUITIVE |

470009 |

1.20% |

0.60% |

|

10 |

直观医疗 INTUITIVE |

470008 |

1.20% |

0.60% |

Although the da Vinci surgical robot will still dominate in 2023, China's surgical robot market will face more fierce competition in 2024 as domestic enterprises such as MicroPort, Kangduo, Jingfeng, TINAVI, and Weigao will obtain market access permits in 2023 or 2024.

The winning of the bid for the packaging of the two domestic surgical robots of Jingfeng and TINAVI may indicate that domestic brands will jointly promote the development of the domestic market through joint efforts. In the future, it is worth continuing to pay attention to whether domestic surgical robots can occupy a larger share in the fierce market competition.